How Much Should You Really Spend on an Engagement Ring? Here's the Truth

![]() Published on: 14th Mar 2023

Published on: 14th Mar 2023

How Much to Drop on Her Engagement Ring?

In the 1930’s, De Beers launched one of the most successful marketing campaigns in history. In fact, it was so successful that while the campaign itself has long faded from public memory, its effect continues to resonate throughout the culture.

I’m referring, of course, to the De Beers diamond campaign.

It was this campaign that elevated the diamond to its ubiquitous status, distinguishing it as the symbol for eternal love. After all, as the toughest mineral on earth diamonds are indeed forever. The campaign also successfully conveyed to the public just how much an engagement ring should cost. The verdict? One month of your salary—aptly known as the One-Month Rule.

In the 80’s, a timely ad campaign upgraded this to the Two-Month Rule. Meanwhile, in Japan—where honour and ritual are strongly bound—this became the Three-Month Rule.

So, before the One-Year Rule becomes the norm, we took a moment to ask ourselves: What amount of money should you really spend on diamond engagement rings? Here, we look at some recent statistics and other factors to give you the most precise answer in 2021!

What Do Other People Spend on Online Engagement Rings?

Perhaps the One-Month, Two-Month, and Three-Month Rules aren’t your cup of tea. Another method for deciding how much to spend on an engagement ring online is by simply referring to the national average. Basically, how much are other people currently spending on their engagement rings?

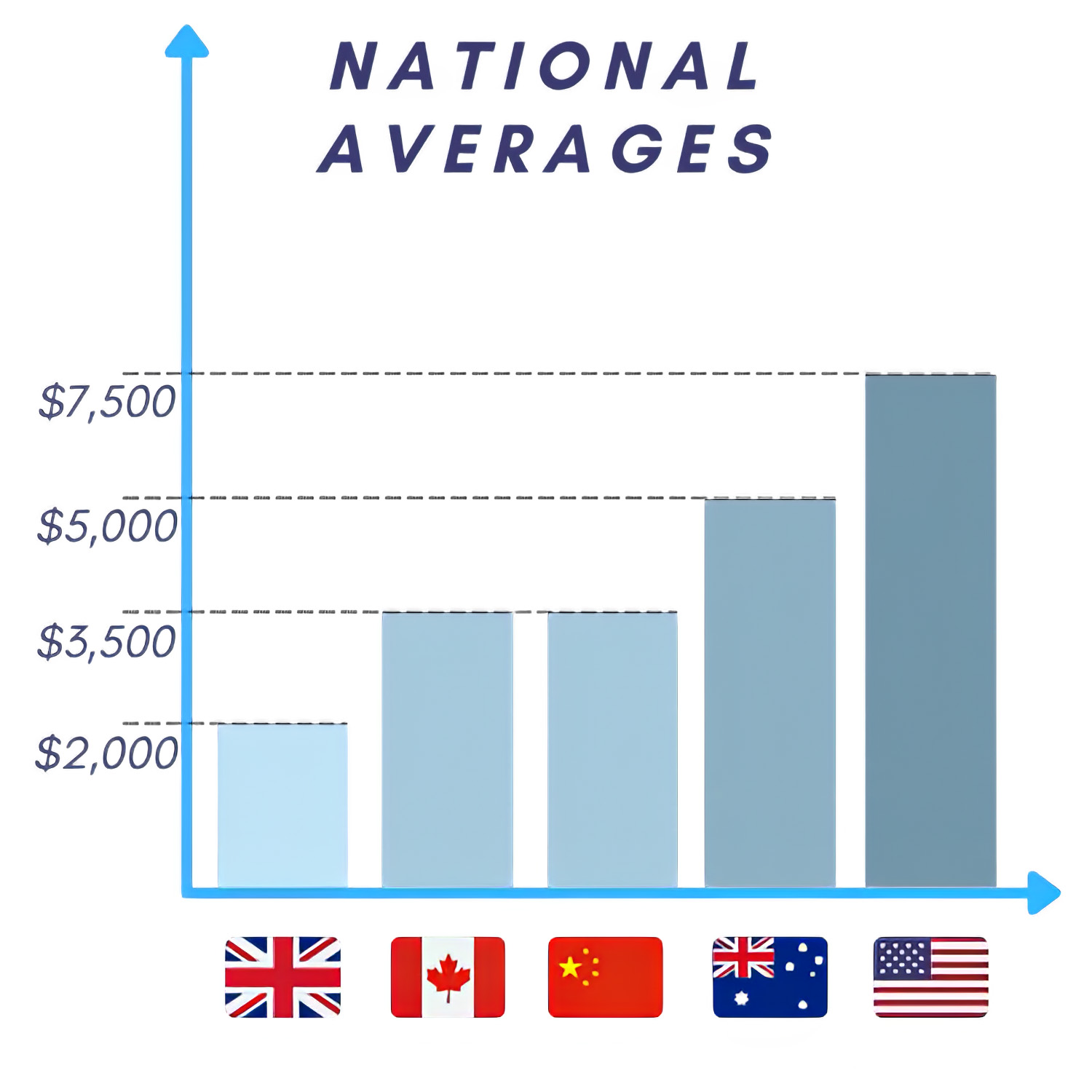

Though this changes from year-to-year and country-to-country, here’s a few generalizable findings. According to CreditDonkey, the 2020 national averages for engagement ring spending were highest in the United States and lowest in the United Kingdom. Below is a graph illustrating the differences across five nations.

How Much Does She Expect Me to Spend on an Engagement Ring?

Diamond engagement rings for women can cost you anywhere between a few hundred dollars to a small fortune. It depends on a wide array or personal factors. While the X-Months Rule still lingers like a cultural poltergeist, the choice is really between you and your future fiancée.

With the increasing popularity of alternative gemstones, black diamond rings, and lab created diamonds, the precise amount you can expect to spend varies wildly.

Majesty Tip: The price tag should matter to you only as much as it matters to her. If she has a taste for the finer things in life, invest in something that is sure to delight. If, on the other hand, she’s more interested in the symbolism behind the gesture, choose a more humble ring that conveys the depth of your love and commitment.

The truth is, sometimes her expectations and your budget don’t quite correlate—and not in the good direction. So if you really want to get her the perfect engagement ring but can’t afford it in one shot, financing with your jeweller is an excellent option. For instance, we offer 0% APR financing on pieces $1,000.00 or more. This saves you from monstrous interest rates you would incur with credit.

How do I Budget for an Engagement Ring?

To hone in on your budget, there are several key financial factors to consider. These can largely be broken down into the following five categories.

Debt-to-Income Ratio: This is a function that divides your total monthly debt by your gross monthly salary. Debt encompasses everything from student loans, to credit cards, to mortgages. The final percentage represents the portion of your income that covers your debt. If you have a high debt-to-income ratio (>43%), reconsider how much you can really afford to spend on an engagement ring. Likewise, a low percentage gives your budget more flexibility.

Majesty Tip: An engagement ring shouldn’t break the bank. While the various “rules” stipulate spending anywhere between one and three month’s salary, your actual financial situation offers a more nuanced perspective of what you can afford.

Conclusion

At the end of the day, what you spend on an engagement ring should be a balance between your budget and your bride-to-be’s expectations. While it helps to refer to the national average, don’t feel compelled to go into serious debt just to fall within the statistical bell-curve.

Remember, an engagement ring is a symbol of your love and commitment. So whether you drop five figures on a statement piece or just a few hundred on a little treasure, Majesty Diamonds is here to help. Schedule your rendez-vous with one of our caring professionals today and find out why our customers believe we’re a 5-star company!